All Categories

Featured

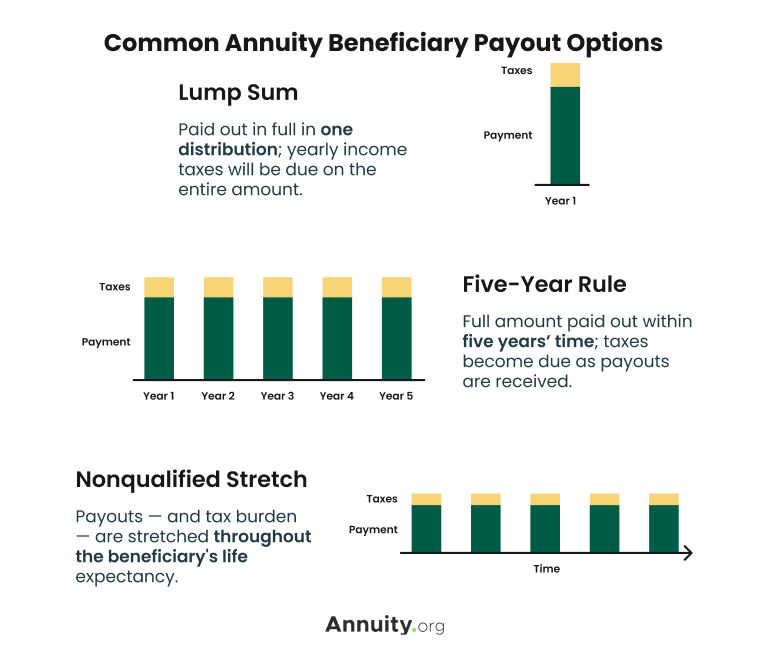

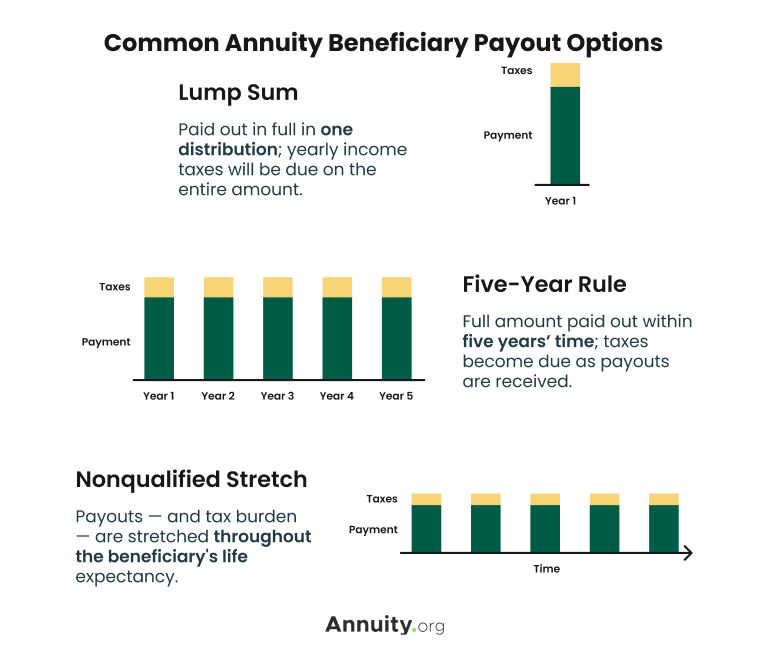

Two individuals acquisition joint annuities, which offer a guaranteed revenue stream for the rest of their lives. If an annuitant dies throughout the distribution period, the continuing to be funds in the annuity may be handed down to an assigned beneficiary. The specific options and tax obligation implications will certainly depend on the annuity contract terms and relevant regulations. When an annuitant passes away, the interest gained on the annuity is dealt with differently depending upon the kind of annuity. With a fixed-period or joint-survivor annuity, the interest continues to be paid out to the surviving recipients. A death benefit is a function that makes certain a payout to the annuitant's beneficiary if they die prior to the annuity payments are worn down. The schedule and terms of the fatality advantage may differ depending on the details annuity contract. A kind of annuity that quits all settlements upon the annuitant's death is a life-only annuity. Comprehending the terms and problems of the survivor benefit before purchasing a variable annuity. Annuities are subject to taxes upon the annuitant's fatality. The tax therapy depends on whether the annuity is kept in a qualified or non-qualified account. The funds are subject to earnings tax obligation in a certified account, such as a 401(k )or IRA. Inheritance of a nonqualified annuity generally leads to taxation just on the gains, not the whole quantity.

If an annuity's marked beneficiary dies, the end result depends on the specific terms of the annuity agreement. If no such beneficiaries are assigned or if they, too

have passed have actually, the annuity's benefits typically advantages generally return annuity owner's proprietor. If a recipient is not named for annuity benefits, the annuity proceeds generally go to the annuitant's estate. Annuity income.

How is an inherited Flexible Premium Annuities taxed

This can supply higher control over just how the annuity advantages are dispersed and can be part of an estate preparation method to manage and shield properties. Shawn Plummer, CRPC Retired Life Organizer and Insurance Policy Agent Shawn Plummer is a licensed Retirement Planner (CRPC), insurance representative, and annuity broker with over 15 years of direct experience in annuities and insurance coverage. Shawn is the owner of The Annuity Specialist, an independent online insurance coverage

firm servicing customers across the USA. With this system, he and his group goal to eliminate the uncertainty in retired life planning by assisting people locate the ideal insurance policy protection at the most competitive prices. Scroll to Top. I recognize every one of that. What I don't understand is how previously going into the 1099-R I was showing a reimbursement. After entering it, I now owe taxes. It's a$10,070 difference between the reimbursement I was expecting and the tax obligations I now owe. That appears very severe. At most, I would certainly have expected the reimbursement to lessen- not totally disappear. A financial consultant can help you make a decision exactly how ideal to handle an inherited annuity. What takes place to an annuity after the annuity proprietor passes away depends upon the regards to the annuity agreement. Some annuities just stop dispersing income repayments when the owner dies. In a lot of cases, however, the annuity has a death advantage. The beneficiary may get all the continuing to be cash in the annuity or an ensured minimum payment, normally whichever is better. If your parent had an annuity, their agreement will specify who the recipient is and may

right into a retired life account. An inherited individual retirement account is an unique pension made use of to disperse the assets of a dead individual to their recipients. The account is registered in the departed individual's name, and as a beneficiary, you are incapable to make additional payments or roll the acquired IRA over to one more account. Only qualified annuities can be rolledover right into an acquired individual retirement account.

Latest Posts

How are beneficiaries taxed on Joint And Survivor Annuities

Do you pay taxes on inherited Multi-year Guaranteed Annuities

Inherited Joint And Survivor Annuities tax liability